Only the property tax rebate – You must complete and submit Form IL-1040-PTR, Property Tax Rebate Form, on or before October 17, 2022.

Both the property tax and individual income tax rebates – You must file Form IL-1040, including Schedule ICR, Illinois Credits, and Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit, to report any eligible dependents, on or before October 17, 2022. If you have not already filed Form IL-10, then in order to receive:. Submit Form IL-1040-PTR electronically through MyTax Illinois or submit a paper Form IL-1040-PTR. If you filed your 2021 Form IL-1040 but did not include your Schedule ICR, then to request the property tax rebate, you must complete and submit on or before October 17, 2022, Form IL-1040-PTR, Property Tax Rebate Form. If you did not receive a refund, then your rebate will be sent by paper check to the address on your return. Your rebates will be sent automatically in the method that your original income tax refund was sent. For taxpayers that have filed their 2021 Form IL-1040 and Schedule ICR, Illinois Credits, nothing additional is needed for the property tax rebate and the individual income tax rebate. 15, 2023 to get their returns in and still qualify for the rebate, which will be paid about one month after the state processes their returns. Eligible filers were entitled to a refund of 14.0312% of their 2021 Massachusetts state tax liability. 2022, and those payments are essentially over. Massachusetts began paying out state tax refunds in Nov. Take Our Poll: Are You Concerned About the Safety of Your Money in Your Bank Accounts? Massachusetts Those who are approved may receive a rebate up until Sept. However, if you qualify for a payment but have not received one, you still have until June 30 to contact the State Tax Assessor to prove your eligibility. 2023 and have essentially been completed. The final day that residents could have filed for the Maine Winter Energy Relief Payment was Oct.

Both the property tax and individual income tax rebates – You must file Form IL-1040, including Schedule ICR, Illinois Credits, and Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit, to report any eligible dependents, on or before October 17, 2022. If you have not already filed Form IL-10, then in order to receive:. Submit Form IL-1040-PTR electronically through MyTax Illinois or submit a paper Form IL-1040-PTR. If you filed your 2021 Form IL-1040 but did not include your Schedule ICR, then to request the property tax rebate, you must complete and submit on or before October 17, 2022, Form IL-1040-PTR, Property Tax Rebate Form. If you did not receive a refund, then your rebate will be sent by paper check to the address on your return. Your rebates will be sent automatically in the method that your original income tax refund was sent. For taxpayers that have filed their 2021 Form IL-1040 and Schedule ICR, Illinois Credits, nothing additional is needed for the property tax rebate and the individual income tax rebate. 15, 2023 to get their returns in and still qualify for the rebate, which will be paid about one month after the state processes their returns. Eligible filers were entitled to a refund of 14.0312% of their 2021 Massachusetts state tax liability. 2022, and those payments are essentially over. Massachusetts began paying out state tax refunds in Nov. Take Our Poll: Are You Concerned About the Safety of Your Money in Your Bank Accounts? Massachusetts Those who are approved may receive a rebate up until Sept. However, if you qualify for a payment but have not received one, you still have until June 30 to contact the State Tax Assessor to prove your eligibility. 2023 and have essentially been completed. The final day that residents could have filed for the Maine Winter Energy Relief Payment was Oct.

MaineĪs with most states, the time limit to file for a state rebate has already passed. However, the state Comptroller has indicated that payments will continue until all have been issued. Most of those payments have already been made. Octowas the last date that you could file for both the Illinois Income Tax Rebate and/or the Property Tax Rebate. However, for those who got extensions or filed later, rebates are continuing to be processed through the summer of 2023. Those payments have been completed for residents that filed their tax returns on time. Idaho sent out tax rebates and “Special Session Rebates” in March and September 2022.

However, there are still a handful of states that have either recently authorized new stimulus or have yet to distribute all of the money they originally allocated. Unfortunately for those looking for payments, most of the deadlines to file have long passed, and most of the money has already been distributed.

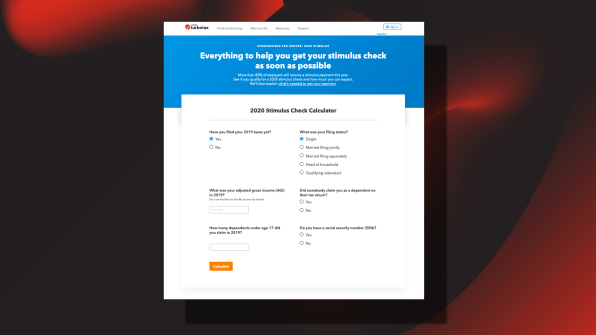

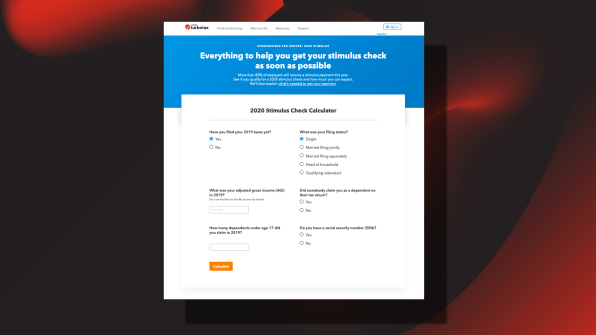

#Turbotax stimulus check rebate how to#

Learn More: How To Build Your Savings From Scratch Mortgage Interest Rate Forecast for 2023: When Will Rates Go Down? The three giant federal stimulus payments in 20 made big headlines, but many states got into the act in 20 as well.

0 kommentar(er)

0 kommentar(er)